Tax Fraud Lawyer New Jersey

Tax Fraud Lawyer New Jersey

Federal offenses are incredibly serious and you should never try to deal with them on your own. You should always hire an experienced federal criminal defense lawyer to help you keep your freedom. If you or someone you know has been accused of tax fraud, you need to contact a tax fraud lawyer New Jersey from Lorraine Gauli-Rufo, Esq. & Associates as soon as possible. He or she will be able to investigate your entire case to determine whether or not you did commit tax fraud and help you navigate throughout the entire process. What will a lawyer do to help?

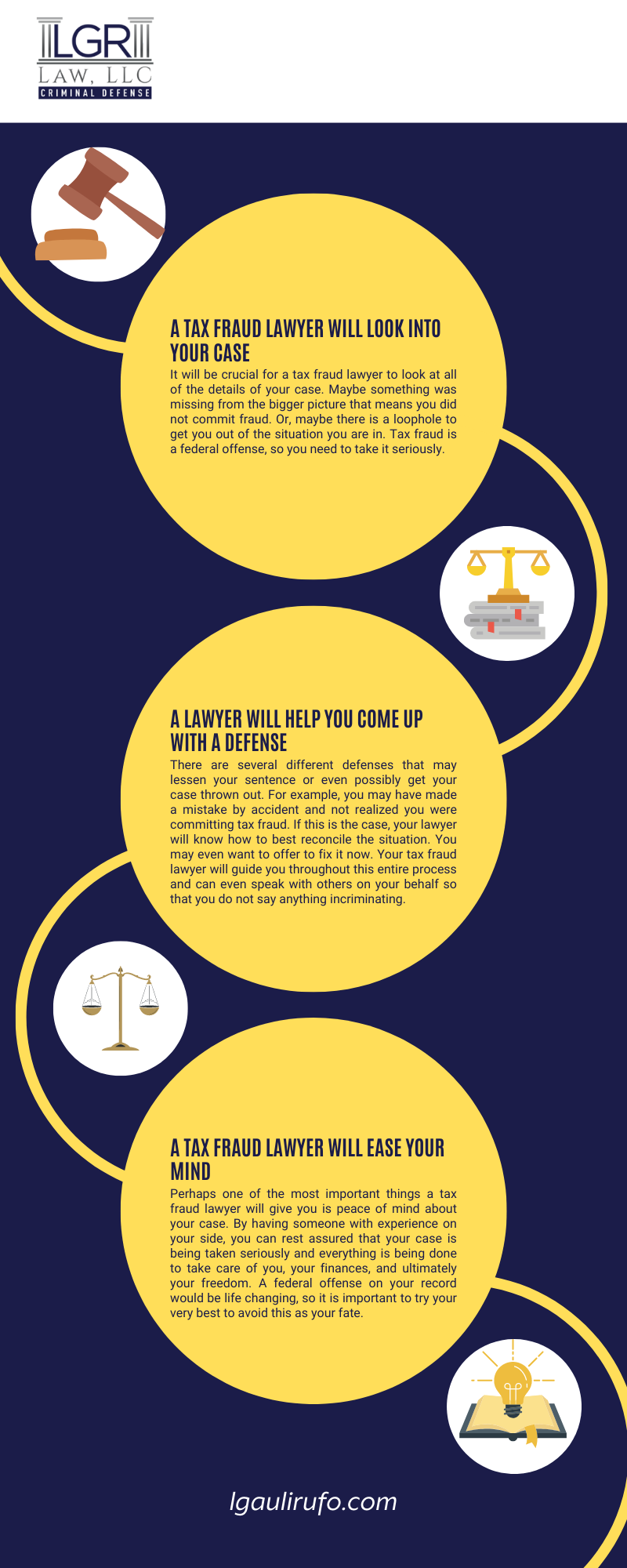

A Tax Fraud Lawyer Will Look Into Your Case

As we mentioned, it will be crucial for a tax fraud lawyer to look at all of the details of your case. Maybe something was missing from the bigger picture which means you did not commit fraud. Or, maybe there is a loophole to get you out of the situation you are in. Tax fraud is a federal offense, so you need to take it seriously.

A Lawyer Will Help You Come Up with a Defense

There are several different defenses that may lessen your sentence or even possibly get your case thrown out. For example, you may have made a mistake by accident and not realized you were committing tax fraud. If this is the case, your lawyer will know how to best reconcile the situation. You may even want to offer to fix it now. Your tax fraud lawyer will guide you throughout this entire process and can even speak with others on your behalf so that you do not say anything incriminating.

A Tax Fraud Lawyer Will Ease Your Mind

Perhaps one of the most important things a tax fraud lawyer will give you is peace of mind about your case. By having someone with experience on your side, you can rest assured that your case is being taken seriously and everything is being done to take care of you, your finances, and ultimately your freedom. A federal offense on your record would be life-changing, so it is important to try your very best to avoid this as your fate.

New Jersey Tax Fraud Law Infographic

Debunking Common Tax Fraud Myths

As you can see, connecting with a respected tax fraud lawyer New Jersey residents trust inspires a variety of different benefits. We have already noted that meeting with a member of the distinguished LGR Law, LLC legal team can help to ease your mind. But you may be surprised to learn that one of the techniques we readily use to put our clients at ease (genuinely, not as a means of distraction) involves debunking tax fraud myths.

All too often, stresses related to the processes of being investigated or charged with tax fraud are rooted in misunderstandings or misperceptions about this legal reality that have been born of myths. By debunking these myths, we empower our clients to make truly informed choices and to have informed emotional responses to the situations they’re facing.

Myth One: Tax Avoidance and Tax Evasion Are the Same Things

It is possible to avoid tax liability lawfully through the utilization of loopholes in the Tax Code and benefits available to those who are eligible for them. Tax evasion is the unlawful avoidance of tax liability via fraudulent means. These terms are not interchangeable.

Myth Two: Evading Taxes Is a Savvy Approach to Liability

As any New Jersey tax fraud lawyer at our firm can attest, tax evasion is not evidence of someone’s intelligence or savvy, regardless of what some high-profile individuals have asserted in recent years. While it is reasonable to take pride in lawfully avoiding taxes if that approach comports with your values, tax evasion can land you behind bars and is not a viable legal strategy.

Myth Three: You Can Commit Tax Fraud Accidentally

Most of the time, tax fraud crimes require some kind of intent. This means that it must be proven that you willfully tried to evade responsibility or to deceive the government before you can be lawfully convicted of tax fraud. In fact, the very IRS definition of tax fraud concerns the willful and material submission of false information concerning tax documentation. While it is possible to commit tax crimes unknowingly (for example, if you had an extremely limited education and never learned that you need to file tax returns annually so you never submit any), committing tax fraud requires intent and there is no such thing as accidental intent.

Myth Four: Only the Wealthy Are Prosecuted for Tax Fraud

While the IRS does not ordinarily investigate or prosecute individuals in lower income brackets for tax fraud, the agency retains the right to do so at any time. Do not take your income bracket for granted. If you are intentionally trying to defraud the government, you need to speak with an attorney about employing a strong defensive legal strategy.

Myth Five: White-Collar Criminal Charges Are No Big Deal

At LGR Law, LLC, we take great pride in representing the interests of our clients. We have seen far too many lives turned upside down by white-collar crime accusations to allow this myth to continue to invade the American water supply. If you have been charged with tax fraud, treat these charges seriously. Connect with a reputable New Jersey tax fraud lawyer on our team as soon as you can so that we can safeguard your freedom and protect your rights as you navigate this very serious and potentially consequential process.

Contact a Lawyer Today to Learn More

Do not hesitate to contact a tax fraud lawyer at the very first sign of needing one. It is important to have someone who is skilled in this field on your side from the very beginning so that you do not miss anything important in your case. Contact a lawyer from Lorraine Gauli-Rufo, Esq. & Associates today to set up a consultation.

Can I Be Charged with a Crime for Completing My Taxes Incorrectly?

New Jersey residents who earn more than $7,500 a year are required to file tax returns. If you don’t do your taxes correctly, you can face civil and criminal penalties. The IRS may decide to charge you with a crime if you don’t file a tax return, provide false statements in your return or purposely evade paying your taxes.

How Are Tax Avoidance and Tax Evasion Different?

Some people use the terms tax avoidance and tax evasion interchangeably. However, they’re quite different. Tax avoidance involves using legal strategies to reduce your taxes. Tax evasion, on the other hand, involves using illegal methods to reduce or completely eliminate taxes.

What Will Happen If I Make an Honest Mistake on My Tax Returns?

Many people make mistakes on their tax returns every year and don’t do it intentionally. They may not pay enough attention and overlook something. If this is the case, you won’t be charged with a crime. However, you may still face civil penalties.

How Do I Know If I’m Being Investigated for Tax Evasion?

While it can be tricky to know when the IRS is investigating you for tax evasion, there are some red flags to be aware of. For instance, if you’re involved in a tax audit and the revenue agent suddenly disappears and doesn’t return your phone calls, there may be an investigation under way. If you have reason to believe that the IRS is investigating you for tax evasion, it’s important to consult a tax fraud lawyer in New Jersey promptly. A lawyer will assess your case and advise you the best way to move forward.

If My Business Partner Is Convicted of Tax Evasion, Will I Also Face Criminal Penalties?

If your business partner is found guilty of tax evasion, you may wonder if you will be in legal hot water too. In this case, your business partner is the only one who would go to prison. On the other hand, you may have to deal with civil penalties. There is a six year statute of limitations to pursue civil penalties for tax evasion.

Should I Hire a Lawyer?

If you’ve been accused of tax fraud, it is in your best interest to retain a tax fraud lawyer. Tax fraud is a serious offense and shouldn’t be taken lightly. A lawyer can come up with the best possible defense for your case and may be able to negotiate lighter penalties.